Instant eCheck Casinos: Canadian Deposit Guide

Welcome to eCheckCasinos.ca, your trusted guide to the most reputable eCheck casinos since 2012 [1*]. We carefully select and review each brand according to our rigorous editorial policy. Below you’ll find an up-to-date list of the highest-rated eCheck casinos Canada currently has to offer:- Canadian Friendly

- Instant eChecks

- No Maximum Deposit

- Live Dealer Option

- www.spincasino.com

- Yes

- Not Accepted

- Yes

- 2001

Top 3 eCheck Brands CA

- 🏆SpinCasino.com is the best eCheck brand for slots & live dealer.

- 🥈RubyFortune.com has the best loyalty program.

- 🥉Mummysgold.com has the best specialty eCheck slots (Egyptian themed).

Responsible Gambling

Legal gambling age is 18+ in Canada and depends on your province. Please check our table for age limits. Ontario is 19+. Always gamble responsibly and don’t wager what you can’t afford to lose. If you seek addiction help, or seek resources please visit ConnexOntario.ca and BeGambleAware.org.

Ads Disclaimer

Kindly be aware that certain links on eCheckCasinos.ca serve as affiliate links. If you choose to click through our links and make a purchase from one of our partners, we may earn a commission at no additional cost to you.

On This Page

🟢 Finding the Best Canadian Casinos that Accept e-Checks

There are many online gambling sites where you can sign up with eChecks in 2024, either by its specific name, or any of its EFT-reliant alternatives. However, if you’re in Canada, your options will be more limited. And if you demand only the best eCheck Casinos with the strictest standards of safety and highest reputation, they’re going to be a lot more limited. As of now, there are only a few solid Canadian online casinos that accept eCheck as a deposit method. The most prominent of these are Spin Casino and Ruby Fortune. Each of these eCheck casino brands are reputable and trustworthy, with long histories of providing excellent customer service.Spin Casino is the best Overall Brand 🎖️ with eCheck

TLDR: c$10 min deposit, no maximum deposit. No transaction fee, instant transfer. NSF return fee of $30.00 for any EFT or ACH that bounces (may vary depending on your bank’s policies). Cashout time from 1 to 7 days. Being at the forefront of casino payment fintech (financial technology), SpinCasino offers a modern take on iGaming with a host of innovative features. You will find: table games, slot machines, and live croupiers via webcams. In terms of promotions, there is a free spins bonus offered (unavailable to Ontario based players). And regarding banking, SpinCasino accepts common alternative payment options such as e-wallets, visa credit cards, and mastercard. Expand for a full list of games offered by Spin Casino. See More🟢 eCheck Casinos Comparison : Speed-o-Meter*

| eCheck Deposit Time | eCheck Cashout Time | Brand Name | |

|---|---|---|---|

| 1 | Spin Casino | ||

| 2 | RubyFortune | ||

| 3 | MummysGold | ||

| 8 | Gaming Club | ||

| 9 | PokerStars |

🟢 🔧 How Do Instant eCheck Deposits Work ?

An eCheck is essentially a paper check that is written and executed electronically. There is no paper, no pen, no need to sign your name to it. It is processed as an EFT – or electronic fund transfer – wherein the online casino and bank communicate the details of the payment. Here’s what happens the moment a player submits an eCheck / EFT deposit [3*]:Casino eCheck Deposit Process Flow:

- step 1: Online casino sends transmission to bank, asking if amount is available.

- step 2: Bank responds with transmission of its own, anwering “Yes” or “No”.

Return Use-Cases:

- If “Yes”, the echeck casino instantly credits the user with the deposited money.

- If “No”, the payment is declined by the casino.

🟢 How to Make a Deposit via eCheck

A – Preparation

- Retrieve Information from Your Physical Checks: You can find all the necessary information for an eCheck – checking account number, bank name, and routing number – on your paper checks. If you don’t have paper checks, a quick call to your bank will provide you with the information.

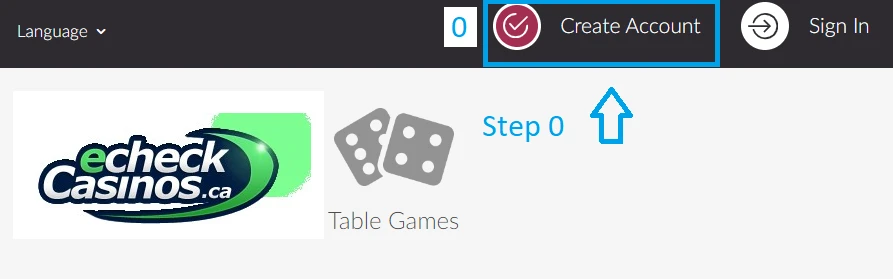

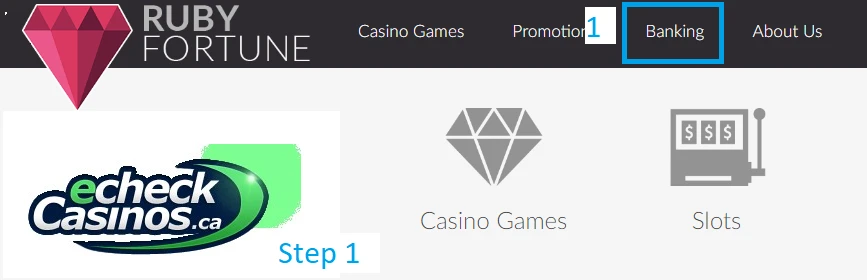

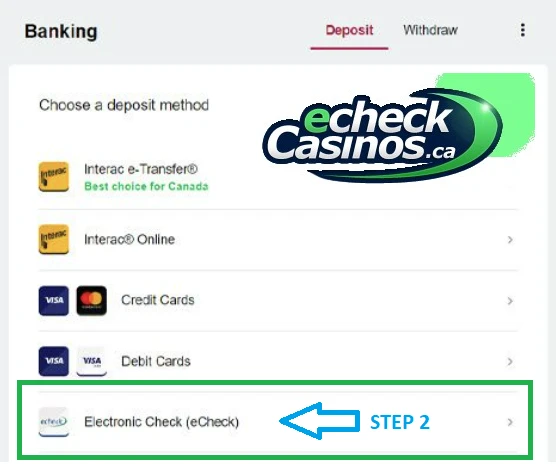

B – eCheck Casino Deposit Steps (Visual)

Click to expand and see screenshots of the deposit process step by step. See More🟢 What are the Pros and Cons of the eCheck Payment Method ?

| Pros | Cons |

|---|---|

| 1. Convenience: Simplified Cheque clearing process. | 1. Processing Time: Electronic transfer may take several days to clear. |

| 2. Cost-Effective: Often lower remittance costs compared to other methods. | 2. Risk of Non-Sufficient Funds (NSF): Payments may fail if the account has insufficient funds. |

| 3. Security: Transactions are secure and use encryption technology. | 3. Dependence on Bank Systems: Relies on the financial institution, and issues may arise if there are payment system issues. |

| 4. Versatility: Can be used for various types of payment services, including one-time and recurring payments. | 4. Not Truly Instantaneous: Unlike some other methods, eChecks may not provide instant fund availability. |

| 5. Reduced Paper Usage: Environmentally friendly, as it reduces the need for paper checks. | 5. Limited International Use: Primarily used within national borders, limiting international payment processing. |

🟢 List of Popular EFT Types Used in Canada

Non-exhaustive, but some common names used for iGaming and online shopping include:- ATM Transfers

- eCheck

- ACH eCheck

- EFT eCheck

- Instant eCheck

- Deluxe eCheck

- Direct Debit

- Direct Deposit

- EFT

- Electronic Check

- iDebit

- Instant Check

- Interac

- Interac eTransfer

🟢 Different Types of eCheck Transactions Explained

There’s more than one type of eCheck, and they aren’t all created equally (nor available in all countries). The two main types are eCheck and ACH and both fall into the umbrella of EFTs [4*] . In EFTs (Electronic Fund Transfers), the merchant and bank initiate a digital communique to ensure the money is available in the user’s bank account. This would typically happen after making a purchase at an e-commerce payment system, or an Electronic funds transfer at point of sale (EFTPOS). For online casinos, this happens at the cashier level and is initiated by the player. It’s all electronic and independant from bank employees. This is the method all Canadian-based banks use when processing an eCheck. Click to learn more and see a comprehensive table comparing eCheck Canada and USA ACH. See More🟢 How has the transition from physical to digital checks impacted online casinos?

The concept of checks has been around for centuries, with the first printed versions emerging in 1762 thanks to British banker Lawrence Childs. The advent of eChecks brought this age-old form of payment into the digital age. Expand for more context and history on the introduction of new financial tools such as instant eChecks. See More

The concept of checks has been around for centuries, with the first printed versions emerging in 1762 thanks to British banker Lawrence Childs. The advent of eChecks brought this age-old form of payment into the digital age. Expand for more context and history on the introduction of new financial tools such as instant eChecks. See More🟢 eCheck withdrawals

Making a withdrawal is arguably the most important part of iGaming. Accessing those winnings is sometimes not trivial, however. Some casino sites require you to complete certain wagering requirements first. This is often part of their deposit bonus T&Cs. Always read the fine print upfront to avoid surprises during cashout. As of 2024, sites like Spin Casino offer a maximum withdrawal limit of C$5,000. If eCheck is not supported, other common withdrawal options include Paypal (where available), paysafecard, or debit cards.🟢 Tips to avoid the worst eCheck Deposit Casinos

When choosing an online casino that accepts eCheck payments, be wary of sites with unclear ownership. Other indicators to look for are lack of contact details, as well as proper licensing and regulation. Carefully review terms and conditions, check for certifications from auditors like eCOGRA, and research your target brand online before signing up. One example of a failed eCheck casino brand was Lock Poker Casino, which had issues with player fund mismanagement. They owed players millions when they closed down in 2015. There were also complaints about the mistreatment of players and general incompetence and scandal surrounding operations. Avoiding unscrupulous sites like these is vital for safely using eCheck. That’s why we maintain our eCheckCasinos.ca safe-list on a near daily basis since 2012.🟢 eCheck Alternatives in 2024

What options do players have if eCheck is not supported ? We like to think of e-Check as the generic payment modality that runs on ACH or CPA. But the range of eCheck options increases when you look for branded forms of eCheck such as Interac, iDebit, Instadebit and Skrill Rapid Transfer. Even Paypal eCheck is a branded EFT type. If these are not accessible, then credit cards, crypto, and ewallets are recommended. You might even find your deposit sweet-spot using something like direct Mobile Carrier Billing via Boku.🟢Additional Resources About Electronic Check Canada

- Step-by-step eCheck Walkthrough

- eCheck Laws

- ACH vs Bank Wire

- Comparing eCheck and Crypto

- The decline of paper cheques in favor of eCheck payments [Payments.ca site]

About Us / What Qualifies Us ?

Our team of experts has been reviewing the best eCheck casinos Canada has to offer, ever since our launch in November of 2011. Our writing team has a combined wealth of expertise spanning over 30 years [8*][9*][10*]. Because we have different backgrounds (some of us are creative types, and others more tech-minded), you will find different voices and points of view reflected within our pages. As well as insider tips and advice. Please expand to read more about our editorial policy plan. See MoreDonna Dorsa

Donna is an accomplished linguistic arts professional with over 15 years in iGaming. She brings a blend of creative literature, mathematics, and game theory expertise into her pieces. She has covered the iGaming sphere from end-to-end, in Canada and abroad. Her articles have received links from Pagat.com, Wikipedia, countless forums and major news outlets. Read the full Donna Dorsa eCheckCasinos.ca Profile.Dana Nikolic

Dana brings a decade of dedicated experience in iGaming and a distinctive personal voice in her pieces. From online gambling to wellness, yoga, and nutrition, her diverse writing portfolio spans major sites like HuffingtonPost, Thrive Global, and Newsbreak. She has been a wonderful addition to eCheckCasinos. Her well thought out pieces and strong social media following reflects a genuine connection to the topics she covers. Read the full Dana Nikolic eCheckCasinos.ca Profile.Trevor Hallsey:

Serving as the editor and a meticulous fact-checker, Trevor ‘The Hawk’ Hallsey is more than just an industry expert. With a decade-long passion for gaming, a background in computer science, and webmaster skills, Trevor provides warm and authentic insights at the crossroads of finance and all things gaming. Read the full Trevor Hallsey eCheckCasinos.ca Profile.Citations and References

- [1] Time-Machine to November 18th 2011 https://web.archive.org/web/20111118022457/https://echeckcasinos.ca/

- [2] List of iGaming Ontario Regulated Sites https://igamingontario.ca/en/operator/operators

- [3] How eChecks work via ACH https://www.authorize.net/payments/echeck.html

- [4] ACH and eCheck are EFTs https://staxpayments.com/blog/echeck-vs-ach-what-are-their-similarities-and-differences/

- [5] AFT Canada https://www.payments.ca/payment-resources/iso-20022/automatic-funds-transfer

- [6] eChecks have been around for 2 decades https://due.com/echeck/

- [7] What is Quick Deposit eCheck https://www.24-7pressrelease.com/press-release/159336/quick-deposit-instant-echecks-instantpokerorg-has-the-scoop

Frequently Asked Questions

Are there any echeck casinos in Canada with sports betting options?

Yes, several sportsbooks in Canada do offer eCheck banking options. These include platforms like Sports Interaction, NorthStar Bets, and Bet365. Although they cater primarily to the sports betting market, they all double as online casinos.

What recourse do players have in the event of a disputed or fraudulent eCheck transaction?

- Players at iGo managed casinos have strong protections, as these sites are required by law to offer fair dispute resolution. If an eCheck deposit goes wrong, players can open a formal complaint with the specific brand and escalate to the provincial regulator if needed. There are clear timelines for casinos to respond and the regulator can compel them to resolve issues.

- For offshore online casinos, players have less certain recourse. They can attempt to dispute the transaction with the casino, but the site is under no legal obligation to investigate or refund the player outside of their own policies. Players may be able to open a claim with their bank's fraud department in cases of unauthorized transactions.

What are the customer support options for eCheck users in Canada?

- Direct support from the individual eCheck casino sites such as:

- Email/help desk support

- Phone support

- Live chat

- Online resources like FAQs and tutorials

- Interactive digital dashboards for tracking transaction status

- Assistance from your bank or financial institution that is enabling eCheck processing for your account. This may include support for setup, integration, and troubleshooting issues.

How can you make sure that an eCheck iGaming brand in Canada is licensed and regulated?

You can verify the licensing and regulation of an eCheck casino by checking the bottom of their website (typically in the footer) for licensing information. Common regulators are: Kahnawake Gaming Commission, MGA, Curacao, UKGC. For Ontario specifically, you need to look for the iGaming Ontario logo/brand. They work closely with the Alcohol and Gaming Commission of Ontario (AGCO) for licensing.

Are there restrictions on eCheck for Canadian players?

Yes, there are some restrictions on eCheck use depending on the individual casino's policies and the player's location. To mitigate eCheck fraud, some casinos (for example Cadtree Limited) implement a 2 week wait time on new players before they can access eCheck in the cashier. Additional restrictions include transaction limits. Lastly, before you can make any transactions, you will need to pass the "Know Your Customer" (KYC) checks. This involves providing proof of identity and address to ensure you are legally allowed to gamble.

Are there any echeck casinos for US players?

Yes, eCheck is also accepted at several US-facing casinos. The availability depends on whether you are playing at offshore or licensed sites. Offshore US-facing platforms currently offering eCheck are: BetOnline, Wild Casino, Super Slots, and Sportsbetting.ag. Within the regulated USA states: BetRivers, Borgata, BetMGM, SugarHouse, Caesars, and PartyCasino all accept ACH from Americans.

Does eCheck have a higher preference among specific age groups, genders, or regions?

- According to data gathered by eCheckCasinos.ca, eChecks tend to be more popular with older players, particularly those over 40. Younger gamblers under 30 prefer other methods like credit cards and e-wallets. The 30-39 age group is a fairly even mix of eCheck and other payment options

- There doesn't appear to be a strong preference for eChecks among any particular gender. Both men and women use eChecks at fairly similar rates for online casino deposits, with only slight skews towards male players

- Geographically speaking, eCheck usage is spread across Canada, but is particularly popular in Ontario. This is likely due to the province's size and the new regulated online casino market there. Atlantic Canada also sees higher eCheck preference compared to other regions

- One demographic where eChecks do very well is with high-stakes casino players. The higher deposit limits and sense of security appeals to VIP gamblers making large transactions. High-rollers are more likely to be older males, aligning with the general eCheck demographic trends.